FundsIndia: Mutual Funds & SIP app for iPhone and iPad

Developer: FundsIndia

First release : 18 Dec 2015

App size: 120.34 Mb

Online Mutual Fund investment, SIP, Stock investment (Equities), Derivatives, NPS, Fixed Deposits & more in one app. Hassle-free, paperless transactions with zero fees.

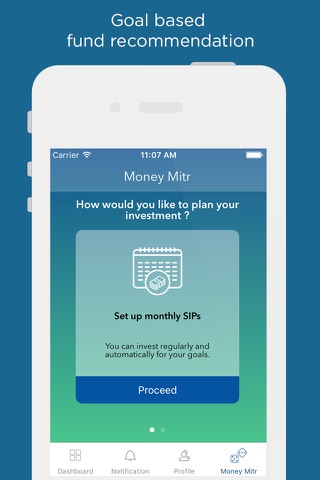

Expert Investment Coaches to suggest the best mutual fund based on your risk appetite, including debt & equity mutual funds, and income tax saving MF to save tax. Avail value-added services like flexible SIPs, trigger-based investing and access to India’s most comprehensive automated investment assistance service – Money Mitr.

Our research articles and media contributions are regularly featured on MoneyControl, Value Research, Mint, Economic Times, Business Times & more.

Free Financial Consultation Service

Online investment platform that offers financial planning and consultation at no cost. Have your dedicated investment coach (SEBI registered) evaluate your fund portfolio periodically to get customised recommendations.

Easy Investments for all

Start investing in the best mutual funds in just a few moments. Whether youre a beginner or a seasoned campaigner, FundsIndia’s versatile platform has you covered. Leave the heavy lifting to us and have a smooth fund investment experience.

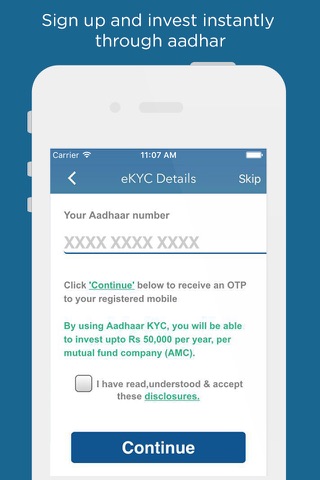

SIP your way to Wealth

Sign up to start an SIP or invest instantly through KYC verification. Make SIP investments in top mutual fund companies on a unified platform. Use SIP calculator to determine your needs based on financial goals or consult your FundsIndia investment coach. Start with as low as ₹1000/month.

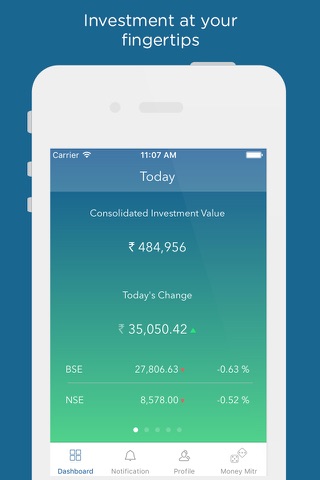

One-stop shop for all your Investment Needs

All-in-one Mutual Fund App & Stock investment App. Monitor & manage all your investments on one convenient dashboard. Invest in SIP and mutual funds online, track their growth, and redeem at your convenience. Get instant alerts for real-time tips, recommendations and notifications regarding NAV & stocks.

Save Tax with ELSS Funds

Tax saving Mutual Funds - Invest in ELSS Fund (Equity Linked Savings Schemes) and save up to Rs 46,800 TDS from your taxable income under Section 80C. ELSS tax saving funds have a lock-in period of 3 years - offering not only higher returns, but also more flexibility than FD (5 years) and PPF (15 years).

Plan your retirement with NPS (National Pension Scheme)

Pension is a boon for old-age, especially for individuals retiring from Private sector jobs. NPS helps individuals to plan their retirement by providing a low-risk appetite investment platform. It is a voluntary retirement saving scheme, which promotes systematic savings across working life, to meet a huge corpus amount at your retirement.

Options Galore - Choose the most suitable funds

Make low-risk mutual fund investments in liquid funds or short-term debt funds, or long-term fund investments in equity mutual funds - small cap, large cap, mid cap, multi-cap - to get potentially higher returns. You could also opt for balanced funds, theme funds, gold funds and international funds, amongst others.

Bank-Level Security

Your data is stored safely and securely – passwords are one-way encrypted before being stored in the database for high security. All communications – either with you, or with mutual fund companies and other service providers – are 256-bit encrypted, and our data is hosted by top-tier hosting service providers.

List of Top Mutual Funds

SBI Mutual Funds

Reliance Mutual Funds

Franklin Mutual Fund (Franklin Templeton)

ICICI Mutual Funds

HDFC Mutual Funds

HSBC Mutual Fund

Bharti AXA Mutual Fund

DSP Mutual Funds (DSP BlackRock)

Axis Mutual Fund

Aditya Birla Mutual Fund (Birla Sun Life)

IDFC Mutual Fund

Kotak Mutual Fund (Kotak Mahindra)

L&T Mutual Fund

Mirae Mutual Fund (Mirae Asset)

Sundaram Mutual Fund

Tata Mutual Fund

UTI Mutual Fund

Invesco Mutual Fund

Principal Mutual Fund

LIC Mutual Fund

BNP Paribas Mutual Fund

Mahindra Mutual Fund

Shriram Mutual Fund

Motilal Oswal Mutual Fund

Tata Mutual Fund

Quantum Mutual Fund

Mutual Fund investments are subject to market risks. Read all offer documents carefully before investing.